how to claim for working from home

If you are an employee who works from home and has set aside a room to be occupied for the purpose of trade eg. Claim 2 for each day that you worked at home during that period plus any other days you worked at home in 2020 due to COVID-19 up to a maximum of 400.

Different Ways To Claim Tax Relief When Working From Home

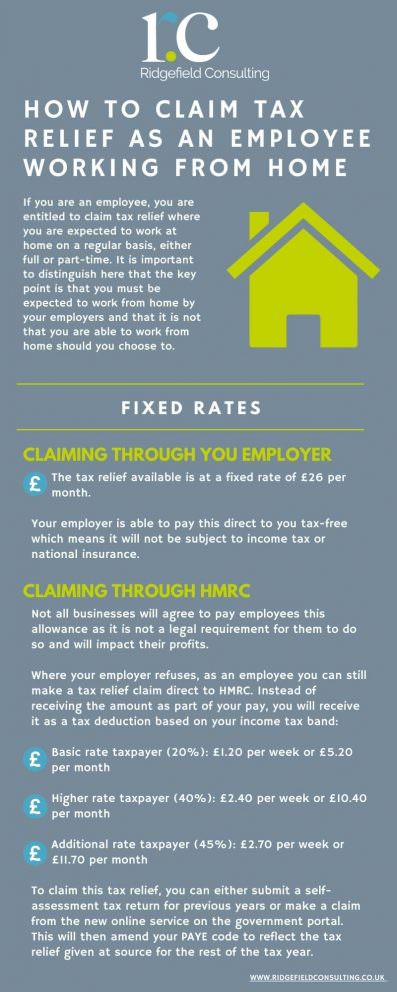

If your employer does not pay you a working from home allowance for your expenses you can make a claim for tax relief at the end of the year.

. Claim the amount on line 22900 of your tax return. This means multiple people working from the same home can each make a claim. How do I claim tax relief for working from home.

You will then come to an employment expenses page and should enter the expenses in the. There are two ways to do this. If you share your bills with someone else the cost is divided between you based on the amount paid by each person see Example 2 below.

Were working from home to fulfil your employment duties and not just carrying out minimal tasks such as occasionally checking emails or taking calls. To claim the tax relief you must have and declare that you have had specific extra costs due to working from home. You need to do this to process the receipts and bills you entered on the Receipts Tracker in myAccount.

Through your employer as a non-taxable benefit. This can be done via your usual expense claim which means cash will usually be paid straight to your bank account and without tax being deducted. You can claim a deduction of 80 cents for each hour you worked from home for the period between.

A link to the online portal can be found here. Due to that there is essentially a flat rate of 6 a week available to you. This includes if you have to.

The home office deduction Form 8829 is available to both homeowners and renters. Fill in the form Count the total number of days you worked from home in 2020 due to the COVID-19 pandemic and multiply that by 2 per day. Employees required to work from home can have a 6 per week or 26 per month allowance paid tax-free by employers or during the pandemic can claim a deduction from earnings for this allowance HMRC has confirmed.

You dont need any supporting documents for this method nor do you need a signed T2200. If you are working from home you have a responsibility to take reasonable care of yourself and other people who may be affected by the work you are doing. Once their application has been approved the online portal will adjust their tax code for the 2021.

How To Claim Work From Home Expenses Due To Covid Jan 07 2019. The allowance is to cover tax-deductible additional costs that. There are certain expenses taxpayers can deduct.

Will I get a cheque in the post. As an employee to claim a deduction for working from home all the following must apply. When completing the employment page there is a question asking if you wish to claim employment expenses.

This amount will be your claim for 2020 up to a maximum of 400 per individual. Get to know how you can claim income tax advantage on house rent allowance when you work from home along with an example of calculation. Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week.

This short video will explain how to upload receipts. NEXSTAR Now that youre working from home you might be wondering which home-office deductions you can legally claim on your 2022 tax returns. As I look back on the golden years of my anime fanhood and compare them to the modern block buster shiney-thing animes for kids Im struck by the changes that have happened in the industry to accommodate the burgeoning western market and by the western animation market to copy.

The maximum you can claim using the new temporary flat rate method is 400 200 working days per individual. Those who do not submit a self-assessment tax return should simply make a claim to HMRC by post telephone or via the new P87 micro-service HMRC launched on October 1 2020. 1 July 2020 to 30 June 2021 in your 202021 tax return.

Employees are not eligible to claim the home office deduction. You must meet the eligibility criteria - Temporary flat rate method to claim your home office expenses. The HMRC online portal is incredibly simple to use and you can make your claim in a few minutes.

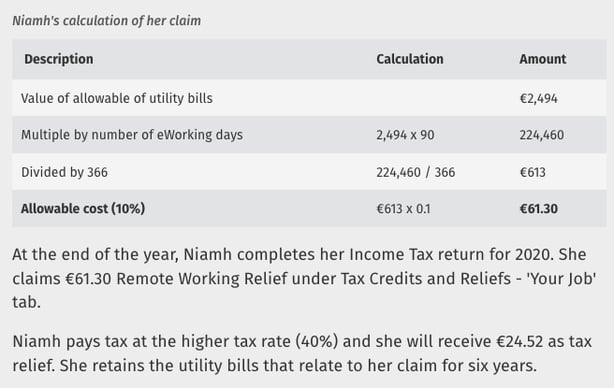

Applying for relief If you are claiming Remote Working Relief you will need to complete an Income Tax Return. Cooperate with your employer and follow their instructions Protect yourself and others from harm during the course of your work. Yet apportioning extra costs such as heating and electricity is tough.

Through HMRC and the usual self-assessment. Head over to the new HMRC tax relief microservice page and follow the instructions there. Employment you may be allowed to deduct certain home office expenses for tax.

Employers can pay you 6 a week extra tax-free. There are three ways to do this. Youll need to have your Government Gateway ID to hand if you dont have one yet you can set it up during this process.

Each individual working from home who meets the eligibility criteria can use the temporary flat rate method to calculate their deduction for home office expenses. Employees can claim allowance for working from home. Here you can claim tax relief on the up to 6 a week cost.

To claim for tax relief for working from home employees can apply directly via GOVUK for free. Detailed method To be able to use this method. They include mortgage interest insurance utilities repairs maintenance depreciation and rent.

You must have spent the money the expense must directly relate to earning your income you must have a record to prove it. You will get money back from the taxes you paid. They do not apply when you bring work home outside of normal working hours.

Claim for your home office if you started working from home at the end of March and worked there for at least 6 months till the end of February 2021 to deduct this benefit in the tax year says Elani van der Westhuizen senior tax technical at TaxTim a digital tax assistant that helps you to complete your taxes by asking you questions.

How Do You Claim Working From Home Tax Relief Bluespot Furniture Direct

Working From Home You Can Claim Coronavirus Tax Relief Suits Me Blog

Claim 6pw For Working From Home Expenses Cardens Accountants

Working From Home Tax Relief How To Claim Tax Relief

Different Ways To Claim Tax Relief When Working From Home

0 Response to "how to claim for working from home"

Post a Comment